The OPay Debit Verve Card is a convenient and affordable way to access your OPay wallet funds at ATMs and make payments at POS terminals. It is issued by OPay in partnership with Verve, a leading payment card scheme in Nigeria.

Opay being the most used fintech app in Nigeria, it’s not surprising it’s widely used by many Nigerians because everything it has to offer.

I’ve been using it for years now, I got mine when Opay started issuing their debit cards to Nigerians.

One of the key features of the debit card that makes it stand out from the rest is that No maintenance fees or stamp fee for the debit card.

What is Opay debit card?

Opay debit card was introduced in 2019 to make things easier for their customers.

You know, when you have money in your mobile fintech app like Palmpay and with no debit card. You’ll have to transfer the money to your other bank that has ATM card to withdraw.

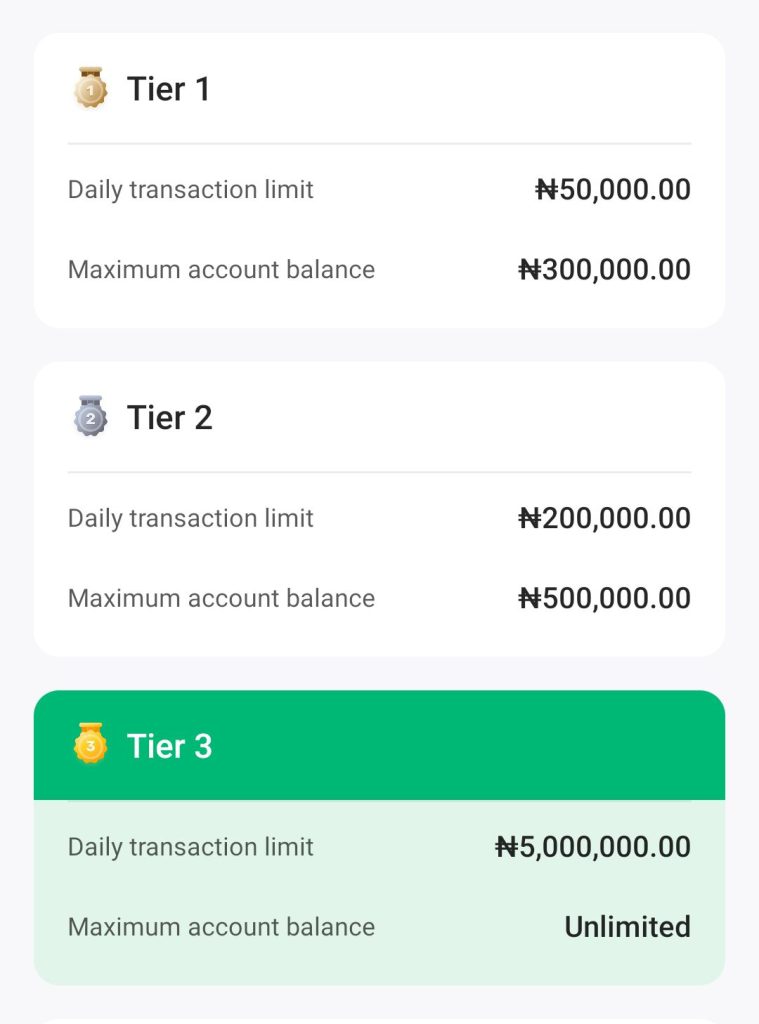

The Opay debit card limit depend on your KYC level, I’d recommend the level 3 of the KYC.

Benefits of Using the OPay Debit Verve Card

- Convenience: Access your OPay wallet funds at any Verve-enabled ATM or POS terminal.

- Security: Your card is protected by a PIN and Verve’s secure transaction processing system.

- Affordability: No annual fees or card maintenance charges.

- Rewards: Earn cashback and other rewards on your transactions.

- Wide acceptance: Verve cards are accepted at over 30,000 ATMs and POS terminals in Nigeria.

Who are eligible for the Opay debit Verve card?

The Opay debit Verve card is the best when it comes to eligibility. Because anyone can get it even when you’re on the default KYC level.

Once you have an account with Opay you’re eligible for a debit card, all you have to do is apply.

How to apply for the OPay Debit Verve Card

There are two ways to apply for the OPay Debit Verve Card:

Through the OPay app:

- Open the OPay app and log in to your account.

- Click on the “Cards” tab.

- Select “Apply for a physical card.”

- Enter your personal information and choose a PIN.

- Pay the issuance fee (₦1000).

- Your card will be delivered to your registered address within 5-7 business days.

Through an OPay agent:

- Locate an OPay agent near you.

- Tell the agent that you want to apply for an OPay Debit Verve Card.

- Provide your personal information and choose a PIN.

- Pay the issuance fee (₦1000).

- Your card will be printed and issued to you immediately.

Different between Opay physical debit vs virtual card?

The Opay debit Verve card which is the physical card, it’s the one that can be use widely through ATM or POS to withdraw.

Just like the name sounds “virtual card”, you should have known it’s used virtually. The virtual card is best for virtual payments and purchases.

How long before the card gets delivered to you?

Getting your Opay debit Verve card is simple as ABC. It going to be delivered to your address within business working days.

Got mine within two weeks, and someone else got theirs within one week after applying.

I can’t really say you’ll get it within certain days, but the maximum is 2 weeks.

However, you can track the delivery through the Opay app, and you’ll probably get a call from the dispatcher before it arrives at your location.

How to Activate Your OPay Debit Verve Card

Once you have received your OPay Debit Verve Card, you need to activate it before you can start using it. Here’s how:

- Open the OPay app and log in to your account.

- Click on the “Cards” tab.

- Select your OPay Debit Verve Card.

- Click on “Activate card.”

- Enter the last four digits of your card number and your PIN.

- Click on “Activate.”

- Your card is now activated and you can start using it!

Additional Tips

- Remember your PIN and keep it confidential.

- Never share your PIN with anyone.

- Report any lost or stolen cards to OPay immediately.

- You can check your card balance and transaction history in the OPay app.

I hope this blog article has been helpful. If you have any questions, please feel free to leave a comment below.